Demand for New York City Properties Remains Strong...

The city’s office property sales market refused to join the stock market’s third quarter swoon. It may have been the stock market’s worst performance since the first quarter of 2009, but office property values continued to inch higher in Manhattan. Given the shaky conditions of the national and global economies, it might seem that the property markets are a bit disconnected from reality; but the building performance fundamentals argue the opposite.

By Peter Shakalis

Occupancy rates remained high in the third quarter and by some measures space availability grew even tighter. In both the Midtown North and Midtown South markets, availability rates continued to fall. The Downtown market saw a jump in the availability rate that was caused by the marketing of space in the World Financial Center. This space has a lease in force until 2013, with much of it still occupied. In fact, Downtown’s vacancy rate actually declined in the third quarter and rent levels in the three major markets moved up again. Moreover, virtually no new buildings will be completed during the next two years; and even then, it will be after 2013 before major large and highly competitive buildings become available for occupancy.

On the negative side, the pace of leasing activity slowed by nearly 20 percent from the level in the first half of 2011. Tenants grew more uncertain about the outlook for their own companies and for rent levels in the near future. Even though a substantial number of deals are expected to close in the fourth quarter, it does appear that sales activity may slow. Investor concerns about the pace of economic activity remain high, and mortgage debt is becoming harder to get and maybe more expensive. Underwriting standards on commercial mortgages grew tighter, with loan-to-value ratios in the area of 65 percent becoming the norm for many solid assets.

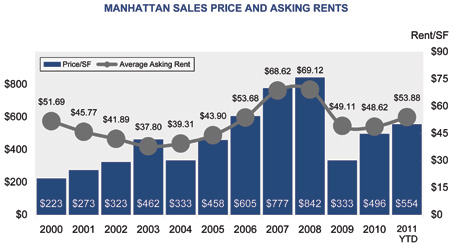

An economic dark cloud may be on the horizon, but the storm may never materialize; and if it does, its potential strength is unknown. The graphs show that average asking rents, building sales prices and activity all increased in the third quarter of 2011 over 2010. While we watch the horizon, some positive business fundamentals can’t be ignored or denied.

Peter Shakalis is a Director at Colliers International NY LLC