PAUL LOUNTZIS, THE DEPENDABLE NAME IN THE MONEY GAME

When Paul Lountzis fainted during an autopsy while he tried studying medicine, he decided that business was a safer course and the career of investment titan Warren Buffett (“The Oracle of Omaha”) was more his inspiration.

“I was thirteen when I read a story in the newspaper about Buffett buying stock in The Washington Post,” says Lountzis, now 61. “So I went to the Reading Public Library to read more about him and I said this guy isn’t even from New York!”

Which made him feel hopeful, since Lountzis himself was a kid from Reading, Pennsylvania, the son of Greek immigrants, a bartender and a seamstress, who couldn’t afford an Ivy League education, so he graduated local Albright College, and then scrapped and outworked everybody as a business analyst for a number of investment firms, before he hit the mother lode and got a job interview with Bill Ruane at the prestigious Ruane, Cunniff & Company in New York.

PAUL LOUNTZIS

“One of Warren Buffett’s best friends, University of Minnesota, Harvard Business School, class of ’49, one of the greatest Harvard Business School classes ever—and I’m sitting there trying to get a job!” Lountzis remembers with typical excitement. “And you can’t make this up, Dimitri—he spent 90% of the time talking about Tyler, our son, who needed open heart surgery at ten-months-old and what an operation like that would cost.”

And then Bill Ruane offered to pay for it.

“So I looked at him and I said, ‘Mr. Ruane, you know, you have to hire me first. And he looked at me and smiled and said, ‘I’m going to.’ So he was just an extraordinary human being. And they would reimburse me for any deductibles. Just extraordinary human beings!”

And the employers he was leaving, Chuck Royce and Tom Ebright of Royce & Associates, even though he was leaving them, paid for his health insurance to cover his son’s medical expenses.

“You hear a lot of negative things about the guys in this field, Dimitri,” says Lountzis, still moved, “and a lot of these hedge fund guys are all about the money. And Bill Ruane was a billionaire, I’m sure Chuck Royce was, but they were really good to me and my family, and really wonderful human beings.”

Paul with Warren Buffett

And when he struck out on his own and founded Lountzis Asset Management in 2000, not far from his old hometown in Pennsylvania (now also with offices on Madison Avenue in New York), he brought with him the small-town values he learned from home and family and working with small-town titans like Buffett (who is donating his entire fortune) and Bill Ruane (who once adopted an entire block in Harlem and paid for housing and clinics and scholarships for every child on the block).

“It’s my family, it’s my faith, and it’s my work,” he says, “I love what I do. I never belonged to a country club. I never golfed in my life. I don’t do any of that stuff. And I work, because that’s what I love.”

And his many clients love him back, because his firm is one of the most trusted, and his returns among the most dependable in the business.

“I don’t want to go into detail, it’s complicated, but we bought fixed adjustable preferred stocks that were generating attractive returns locked in for several years,” he says.

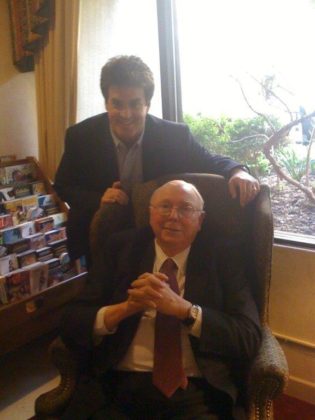

Paul with Charlie Munger

And some of those were $30 million clients, so that’s real money, but he says most of his clients are small business owners, and he’s conscientious about providing them not only with a safe return, but preserving their money (“They’re totally relying on us and that’s an awesome responsibility—I can’t lose their money”) and making sure their kids are provided for.

“The way to describe us is we’re really focused on multi-generational wealth preservation and growth,” he says. “We’ll take the kids, even if they have $5,000. We want to be a true advisor to families and have a personal relationship.”

The issue of trust is why he has his own money in the firm and why he never invests without doing the dogged legwork and research he’s famous for.

“I was a research animal and I’m still a research animal,” he says. “I work weekends, I work 24/7—I just love it—I was up at 3:30 this morning”—on a weekend.

On one research blitz, he practically moved in with a former CEO in Florida to find out everything about his company.

Kelly and Paul with Father Alex Karloutsos and Aristides Logothetis founder of ARC Athens

“I would go visit him at home and I’m really prepared,” he says. “I’ve read the annual, I’ve met with private companies in the industry, I’ve met with consultants, and I sat with him, even though he’s retired two or three years, because he knows the key players in the company and the margins—in other words, doing those interviews that no one wants to do. Doing those interviews brings the numbers to life.”

Like a little company in the auto insurance business which he researched for six months by travelling to Florida and racking up Frequent Flyer miles (“I have gazillions of points”) and which proved a spectacular investment success for his previous firm.

“I spent six months of my life traveling to Florida,” he jokes. “I had gazillion points at Marriott, too. But we got insights that nobody else had. Nobody did.”

Which is why he’s one of the phenomenal gophers of the investment business, a habit he picked up from having to work harder and longer than anybody else because he was the son of immigrants, who was born in Reading, and worked in a field of Harvard MBAs with sterling degrees who barely knew where the money they were juggling came from: but it came from towns like Reading where people often worked their whole lives at backbreaking jobs.

Zachary and Paul with John Catsimatidis and John Catsimatidis Jr.

“And it all starts with my late parents, Yanni and Alexandra, from Katouna, Greece,” says Lountzis. “Just extraordinary people who devoted their lives to us.”

His father came to America and started working at the Berkshire Knitting Mills, until his Uncle Nick asked him to work at his restaurant: Nick’s Chat-a-While Inn.

“And he went in to cook, but he didn’t like the heat,” says Lountzis, “so he became the bartender, and he did that for forty years.”

His mother, he says, was a “genius” and a formidable presence. Her own father was a schoolmaster and she accompanied him on his rounds, where she met her future husband at a neighboring village, and they planned to marry when she came to America.

“Only her mom (now widowed) would not allow her to leave, so she snuck out of the house, made her way to Athens on two ferries, and took a ship to the US—wow!” her son still marvels. “I will tell you, Dimitri, I met Bill Gates, I did work for Warren Buffett, I met people a lot smarter than I’ll ever be, and my dad was a smart man, but my mom, Alexandra, had one of the most formidable minds for any human being I’ve ever met!”

Paul with friends Nick Tsoulos, Ted Moudis, Chris Tsamutalis, Jimmy and George Pantelidis

And the stories he tells about his mother are legion: about her daily routine getting up in the middle of the night to go to work making women’s clothes for local manufacturer’s like Talbots, come home in the afternoon to watch her soaps, go to the restaurant to have dinner with her husband, take the kids to all their sports, come home and cook dinner and clean the house, read her Romantzo and watch Channel 6 Action News, before finally going to bed, only to wake up after midnight to cook her husband dinner when he got home from work.

How she was so devoted to the local parish church, Sts. Constantine and Helen, where she baked the pastries for the bazaar, that she reprimanded the pastor, Fr. Tom Pappalas, for once cutting the service short.

“Then trepeses?” Fr. Tom told her son the story later.

(To honor her memory and help the parish her son every Thanksgiving buys and ships over 500 tsourekia made by the St. Xenia Philoptochos Society of Reading to his clients and friends.)

How she came to school with her son on his first day—to the local Catholic high school, where he had transferred to play football.

Zachary Lountzis with Warren Buffett

“I had this 50-60-year-old lady going to every class with me,” says Lountzis, still stunned. “So finally at the end of the day I said, ‘Mom, why did you embarrass me like that?’ And she said, ‘I had to make sure they’re not going to convert you—na eimouna sigouri!’”

When he met the actor Michael Constantine years later (also from Reading), and his sister Patricia Gordon, and he introduced himself, Lountzis says, “Patricia looks at me and says, ‘Paul?’ I say, ‘Yes’—because we met at church many years ago and I hadn’t seen her in a long time. And she says, ‘You’re Alexandra’s son?!’ So here I was 59-years-old and she’s calling me Alexandra’s son!”

After his aborted attempt at medicine, Lountzis used his smarts in math and science to get a job in Reading doing competitive analysis for Fortune 500 companies looking for mergers and acquisitions (“I worked every weekend and every holiday, and some of the holidays I worked double shifts—once I even worked a triple shift”)—but he couldn’t quite break the glass ceiling of not having a blue-chip college degree.

“So it was July 4th, and they had promoted four consultants to project manager at the company, and all the work I did was stellar, but they wouldn’t promote me,” he remembers the fateful day. “They thought I was the local kid. So, finally, I went in to see the president of the company and I said, ‘Greg, what do I need to do to get promoted?’ And he said, ‘You’ve done a great job, but your resume is never included in the proposals because it doesn’t sell: you have a BS in Finance from Albright and these guys have engineering degrees from Carnegie Mellon and MIT and Harvard and Stanford.’”

So the next day he went home and started cold-calling all the heavy hitters in the industry—including Warren Buffett—and through a Reading connection got a call back from Tom Ebright at Royce & Associates and another from Chuck Royce on January 1st that hired him and changed his life.

Paul and son Zachary with John Catsimatidis and Tom Constance

“He left a message on my answering machine–and I kept that little Sony tape for a long time,” he still marvels.

The rest is history, and in its quarter-century of working for its clients Lountzis Asset Management has survived and prospered by staying true to its small-town values.

“I don’t want to be showing up somewhere and people look at me think I’m some insurance guy trying to get them as a client,” he says. “I want to build friendships and get them to know I’m honest and high grade, get them to know me as a person. Please feel free to call me. I’ll explain everything to you. This is your money. You bled for this. I don’t want to buy something at 70 and have it go down to two: I’d have a heart attack.”

Lountzis runs the firm with a trusted and longstanding team (“Tina (Schaeffer) has been with me 20 years, Mike Auman forever, and my brother John helped me get a lot of the business off the ground”). And his son Zachary has also joined the firm.

“He spent 10 years on Wall Street, he met Buffett and Munger at Berkshire when he was 11, he graduated the University of Arizona with a 3.87 GPA, he worked for Credit Suisse and Jefferies,” says his proud dad.

Only he didn’t want to hire him.

With dear friends Joe and Carol Sano. Joe is Executive Director and Co-founder of St. Francis Food Pantries and Shelters feeding thousands in NYC

“I didn’t want any of my kids in the business,” he says.” It’s too hard, it’s too stressful, even though I love it.”

Until two guys met him for lunch (at Avra, Madison Avenue, his regular business lunch stop) and they told him they wanted to hire his son if he didn’t. Only he still didn’t hire him–until Zachary himself told his dad he wanted in.

“So I thought about it, Dimitri: ‘Honey, do you understand the risks and sacrifices?’ I told him.”

He did, and his father hired him in 2019, “and he’s been a godsend. He’s had a huge impact. I studied a (semiconductor) company called Applied Materials for thirty years, but he was the one who actually drove me to finally buy it.”

And though Lountzis wanted his kids to stay out of the financial world, the apple doesn’t fall far from the tree: his daughter Lauren works for Bank of America, and Ryan covered software at Stephens Inc before he moved to Jefferies. Only son Tyler took his dad’s advice and stayed away, and instead joined the military and served in South Korea and Iraq, then went to trade school and became a welder.

“He’s doing very well,” says his dad, both proud and amazed.

And in typical fashion, Lountzis is most enthused about his wife Kelly.

Our entire family in Santorini, Greece (in order left to right-Paul, son Zachary, son Tyler, daughter Lauren, sister in law Vickie Jones, son Ryan, wife Kelly)

“We’re going on 37 years married, this December will be 40 years since we met, and she has been the greatest blessing on earth. Our daughter Lauren was diagnosed with Type 1 diabetes at six months. She was born October 9th. I came home from Europe October 7th: I was doing work for Bill (Ruane) and Buffett. But then I left October 11. So here was a woman with three children under five, and a diabetic daughter she had to get up every night at two or three in the morning and check on her. And in those days I was away almost 200 days out of the year. So I’m just so blessed to have her. Blessed and grateful.”

Lountzis is a member of the Leadership 100 Endowment, the Faith Endowment, the National Hellenic Society Endowment, AHEPA, and on the Board of Directors of the Police Athletic League. And he lectures at various colleges and universities.

“And the reason I do that is not because I’m wonderful,” he says. “I talk investing—I don’t do PowerPoint and all that nonsense—I talk about life, and I talk about how the value and quality of your life will be dictated by the quality of your relationships. Buffett once said the most important factors in your life are who your parents are—and I have been blessed there—and who you marry—and I have been blessed there, too. That’s the kind of stuff I talk about.”

Which made Warren Buffett bring Main Street to Wall Street and become a legend, and makes Paul Lountzis—the son of immigrants, a son of Reading—one of the most trusted names in the money game.

0 comments